|

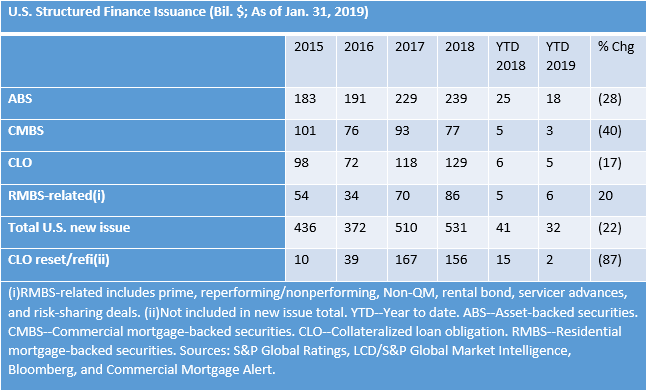

U.S. Structured Finance Issuance Was Slow To Start, But Picked Up Steam Heading Into Feb. (Erb/Manzi) U.S. structured finance markets were a little slow out of the gate this year, as broader market volatility and uncertainty surrounding the length of the partial government shutdown roiled issuance during the beginning, and middle, of January. Total new issue volume was $32bn for the month, down from $41bn in the same period one year ago, with only one of the four major sectors (RMBS) posting a y/y increase. Heading into February, pipelines remain active, building on momentum stemming from a more positive tone toward the end of January, although market players will surely be keeping a close watch on the goings-on in Washington D.C. as well as the steady flow of corporate earnings reports.

ABS issuance reached $18bn this month, down 28% y/y. Auto loan/lease ABS accounted for about $9bn, with equipment, student loans, personal loans, and non-traditional/esoteric issuance adding about a billion each. The remaining $5bn came from a strong start to the year from credit card ABS issuance (up 16% y/y), buoyed by several cross-border transactions from Canadian banks. To view our latest ABS commentaries, including the latest auto loan ABS tracker, click here. Amid volatility in the underlying leveraged loan sector, CLO volume (including new issue, resissue/reset and refi) was down 67% y/y to $7bn, largely a result of a $12bn decline in resets and refis. In fact, January saw just one refi and two resets, totaling $2bn. New issuance only fell about $1bn from last January (see the table below), as the market picked up some steam toward the end of January with $5bn in pricings. Click here and view our latest CLO Research including our CLO Spotlight: Sector Averages of Assets Held in Reinvesting U.S. BSL CLOs: Fourth-Quarter 2018, where we discuss rating trends by industry. CMBS added $3bn in new issue volume from three single borrower transactions and a small balance deal. In contrast, last January saw $5bn in total issuance from two conduits and seven non-conduit deals. That said, several conduits are on the near term pipeline, as activity is set to pick up over the coming weeks. Click here for our most recent CMBS research, including our Q4 2018 CMBS Conduit Update, U.S. Lodging Industry Market Conditions article, and Transaction-Specific Expected Loss paper. Or, if you prefer, click here for our most recently published SF podcast (part of the "Take Notes" series), where we discuss the latest CMBS market trends and impressions from the recent CREFC conference. Private Label RMBS issuance was $6bn, up $1bn y/y, and the only major sector to post a gain. The monthly total included about $3bn in prime, $1bn CRT, and $1bn Non-QM issuance. We continue to expect the Non-QM market to experience the largest percentage growth in 2019, which we discuss in our recent commentary, U.S. Residential Mortgage Finance 2019 Outlook: Rising Interest Rates Likely Won't Disrupt Mortgage Volumes Or Performance available here.

Turning to the Numbers

The 10yr Treasury was 2.68% for the week ending February 1, down from 2.76% last week, despite increasing some 5bp on Friday following the jobs report. NYMEX crude oil was up $1.66 w/w to $55.35. U.S. regular gas prices averaged $2.26 this week, down 1 cent w/w and down 34 cents y/y. The S&P 500 was up 1.57% w/w to 2706.53. The 30-year fixed-rate mortgage increased to 4.46%, up 1bps w/w (up 24bps y/y). The Euro was trading at $1.1461, up $0.0048 w/w.

Recent Short Articles (available here)

Four Ratings Raised, 232 Ratings Affirmed On 17 U.S. And Canadian Credit Card ABS Trusts

Buyer Beware: The Curious Case of Income Supplemented BTL

New Commingling Reserve Mechanism in German Auto ABS Requires Further Considerations in Our Cash Flow Analysis

Fewer Structural Protections in Today’s Speculative-Grade Subprime Auto Loan ABS

Single-B Subprime Auto Loan ABS Gain Popularity as Industry is Poised for Consolidation

Recent In-Depth Articles (available here)

CLO Spotlight: Sector Averages Of Assets Held In Reinvesting U.S. BSL CLOs: Fourth-Quarter 2018

U.S. Auto Loan ABS Tracker: November 2018

Transaction-Specific 'B' Economic Stress Loss Projections For U.S. And Canadian CMBS Transactions As Of December 2018

CDO Spotlight: Performance Benchmarks For S&P Global Ratings-Rated CLO Transaction: Fourth-Quarter 2018

CLO Spotlight: The Most Widely Referenced Corporate Obligors In Rated U.S. CLOs: Fourth-Quarter 2018

As Boom In U.S. Lodging Industry Slows, CMBS Backed By Hotel Loans Face Changing Market Conditions

U.S. CMBS Conduit Update Q4 2018: Metrics Deteriorated A Bit, Stable Ratings Expected In 2019 With Some Caveats

Global Structured Finance Outlook 2019: Securitization Continues To Be Energized With Potential $1 Trillion in Volume Expected Again

Quarterly U.S. Credit Card Quality Index: Performance Remains Stable As Issuance Volume Declines

Is There Extension Tension In U.S. Subprime Auto Loan ABS?

Request For Comment: Global Methodology For Solar ABS Transactions

CLO Spotlight: European CLO Recovery Rates: Stability Continues Despite Deteriorating Credit Quality Of Leveraged Loans

CLO Spotlight: Although U.S. CLO Issuance Remained High, Rising Collateral Quality Pressures Resulted In A Cloudy Third-Quarter 2018

What's In Your CLO? A Second Deep Dive Into U.S. CLO Portfolios Highlights Deal Variance

U.S. FFELP Student Loan ABS: Methodology And Assumptions

Sector Averages Of Assets Held In Reinvesting U.S. BSL CLOs: Third-Quarter 2018

Credit FAQ: How We Rate Brazilian Covered Bonds

Extension Risk In Rated FFELP Student Loan ABS Transactions: FFELP Maturity Tracker September 2018

S&P Global Ratings' CLO Primer

Non-Qualified Mortgage Prepayments: Is It Life In The Fast Lane, Or Will They Start To Take It Easy?

Take Notes (available here)

Conference Recap: CREFC 2019 And A Look Across The CMBS Market

The Lowdown On LatAm

Hot Takes From Opal’s 2018 CLO Summit

When You Use Your Whole Business To Securitize…

The "Unwoke" Millennial Housing Market

The Perfect Storm... For Defaults?

ABS East Recap

Recent Presales (available here)

U.S. ABS: GLS Auto Receivables Issuer Trust 2019-1

U.S. ABS: Toyota Auto Receivables 2019-A Owner Trust

U.S. ABS: Trillium Credit Card Trust II (Series 2019-2)

U.S. ABS: Trillium Credit Card Trust II (Series 2019-1)

U.S. ABS: GreatAmerica Leasing Receivables Funding LLC (Series 2019-1)

U.S. ABS: Flagship Credit Auto Trust 2019-1

U.S. ABS: DT Auto Owner Trust 2019-1

U.S. CMBS: Waikiki Beach Hotel Trust 2019-WBM

U.S. RMBS: COLT 2019-1 Mortgage Loan Trust

U.S. CLO: Neuberger Berman Loan Advisers CLO 32 Ltd.

U.S. CLO: AIG CLO 2018-1 Ltd./AIG CLO 2018-1 LLC

U.S. ABS: Discover Card Execution Note Trust Class A (2019-1)

U.S. CMBS: Benchmark 2019-B9 Mortgage Trust

APAC RMBS: Japan Housing Finance Agency (Series 141)

U.S. ABS: CNH Equipment Trust 2019-A

U.S. ABS: Stack Infrastructure Issuer LLC (Series 2019-1)

Recent European Articles and Presales (available here)

Changes Ahead: How Spain's New Mortgage Law Could Affect New And Outstanding RMBS Transactions

Spanish Covered Bond Market Insights

Countdown To Brexit: Uncertainty Created For Cross-Border Derivative Contracts Supporting Structured Finance Transactions

Global Covered Bond Characteristics And Rating Summary Q4 2018

New Issue: Income Contingent Student Loans 2 (2007-2009) PLC

Presale: STRONG 2018 B.V.

Presale: Salus (European Loan Conduit No. 33) DAC

New Issue: Citizen Irish Auto Receivables Trust 2018 DAC

|