Structured Finance YTD 2019 New Issuance Comes in at $181Bn (Erb/Manzi)

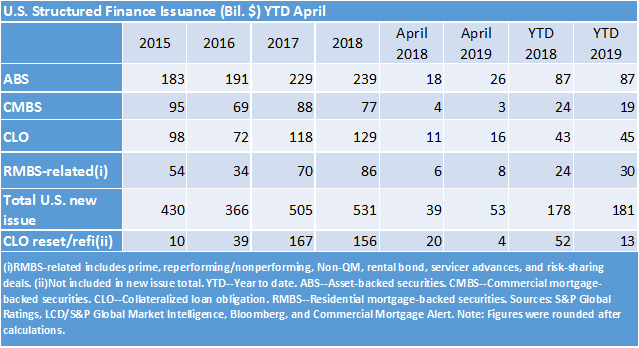

Led by strong y/y new issuance growth in ABS, CLOs, and RMBS, April's structured finance (SF) new issuance volume came in at $53bn, up 33% relative to April 2018. April's uptick in volume help push YTD 2019 new issuance past the corresponding 2018 level. On a YTD basis, SF new issuance volume reached $181bn, up slightly from $178bn YTD in April 2018.

ABS new issuance volume came in at $26bn in April, up 48% from last April's figure. On a YTD basis, ABS issuance was $87bn at the end of April, nearly unchanged from last year's figure. Making up half of ABS volume this year, Auto ABS issuance was up 19% YTD and up 34% relative to April 2018. On a YTD basis, equipment ABS volume was up 50%, cards were down 7%, and student loan ABS was down 16%. To view our latest ABS commentaries, including our Annual Subprime Auto Loan ABS Tracker and our February U.S. Auto Loan ABS Tracker, click here.

CLO new issuance volume came in at $16bn in April, up 44% relative to last April's figure. YTD, CLO new issuance is now at $45bn, up from $43bn YTD in 2018. CLO resets and refis continue to be far lower this year and are currently at $13bn YTD, down 75% from 2018's YTD figure, as spreads began the year wider, and have shown few signs of tightening back to levels that would spur more activity. Click here to view our recent CLO publications, including our CLO Spotlight article, Sector Averages Of Assets Held in Reinvesting U.S. BSL CLOs: First-Quarter 2019.

CMBS new issue volume totaled $19bn YTD, down from $24bn YTD in 2018. For the month of April, CMBS new issue volume was down from about $4bn last April to $3bn this year, with declines in volume for both conduit and non-conduit deals. (Note: We do not include CRE CLOs in our CMBS totals.) Click here to view our recent CMBS publications including Co-working May Come With Risks For Office Landlords And CMBS Investors.

Private Label (PL) RMBS related issuance came in at $8bn in April, up 17% relative to last April's figure. YTD PL RMBS related issuance is at $30bn, up 22% from this time last year. Non-QM issuance continues to have a strong year and is now over $6bn YTD, over double last year's figure. Click here to read our recent RMBS related publications, including our Pre-2009 U.S. Residential Mortgage Performance Snapshot.

Turning to the Numbers...

The 10yr Treasury was 2.52% for the week ending May 3, up slightly from 2.50% last week. NYMEX crude oil was down $1.44 w/w to $61.86. U.S. regular gas prices averaged $2.90 this week, up 2 cents w/w and up 8 cents y/y. The S&P 500 was up 6pts w/w to 2946. The 30-year fixed-rate mortgage dropped 6bps w/w to 4.14% (down 41bps y/y). The Euro was trading at $1.12, up a cent w/w.

Recent Presales (available here)

U.S. ABS: Navient Private Education Refi Loan Trust 2019-C

U.S. ABS: CLI Funding VI LLC Series 2019-1

U.S. CLO: Dryden 72 CLO Ltd

APAC RMBS: Mortgage House RMBS Series 2019-1

U.S. CRT: Freddie Mac STACR Trust 2019-HQA2

U.S. ABS: Vermont Student Assistance Corp. (Series 2019A And 2019B)

U.S. ABS: Toyota Auto Receivables 2019-B Owner Trust

U.S. ABS: GM Financial Automobile Leasing Trust 2019-2

U.S. ABS: GLS Auto Receivables Issuer Trust 2019-2

U.S. ABS: Massachusetts Educational Financing Authority Issue L Series 2019

U.S. CLO: MMCF CLO 2019-2 LLC

Take Notes (available here) Covering New Ground: Covered Bonds Expand Into New Markets

Blockchain On The Brain

Across The Pond With European CMBS

Conference Recap: SFIG Vegas 2019

On PACE For A Greener Future In Structured Finance

Conference Recap: CREFC 2019 And A Look Across The CMBS Market

The Lowdown On LatAm

Hot Takes From Opal’s 2018 CLO Summit

When You Use Your Whole Business To Securitize…

The "Unwoke" Millennial Housing Market

The Perfect Storm... For Defaults?

ABS East Recap

$129bn in Q1 Issuance with $48bn in March

February Posts $48bn as Volatility Subsided

U.S. Structured Finance Issuance: January Was Slow to Start, But Picked Up Steam Heading Into February

Four Ratings Raised, 232 Ratings Affirmed On 17 U.S. And Canadian Credit Card ABS Trusts

Buyer Beware: The Curious Case of Income Supplemented BTL

New Commingling Reserve Mechanism in German Auto ABS Requires Further Considerations in Our Cash Flow Analysis

Fewer Structural Protections in Today’s Speculative-Grade Subprime Auto Loan ABS

Single-B Subprime Auto Loan ABS Gain Popularity as Industry is Poised for Consolidation

Recent In-Depth Articles (available here)

Swedish Covered Bond Market Insights 2019

Future Of Banking: Fintech Flags Turning Point For Australian Banking

Subprime Auto Loan ABS Tracker: Losses Have Stabilized, But Renewed Growth Bears Watching

U.S. Auto Loan ABS Tracker: February 2019

CLO Spotlight: Sector Averages Of Assets Held in Reinvesting U.S. BSL CLOs: First-Quarter 2019

Harmonization Accomplished: A New European Covered Bond Framework

Global Structured Finance Issuance Volumes For Q1 Steady As China Growth Offsets Declines In Europe And U.S.

Co-working May Come With Risks For Office Landlords And CMBS Investors

Key Factors For Assessing U.S. Non-Qualified Mortgage Bank Statement Loans

CLO Spotlight: Performance Benchmarks For S&P Global Ratings-Rated CLO Transaction: First-Quarter 2019

CLO Spotlight: The Most Widely Referenced Corporate Obligors In Rated U.S. BSL CLOs: First-Quarter 2019

New Issue: Takarek Mortgage Bank Co. PLC (Mortgage Covered Bond Program)

New Covered Bond Markets Set To Expand Amid Legislative And Market Developments

Covered Bonds In New Markets: Research By S&P Global Ratings

U.S. CMBS Conduit Update Q1 2019: Loan Metrics Improve As Steady Conditions Prevail

|