Structured Finance Q1 2019 New Issuance Comes in at $129Bn; Down 7% from 2018 (Erb/Manzi)

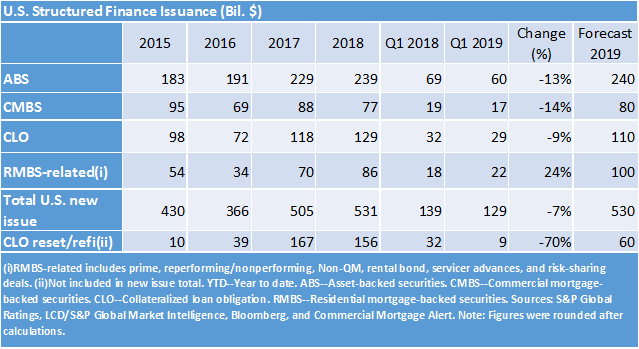

Partially offset by strong issuance in the private label RMBS (PL-RMBS) space, structured finance (SF) Q1 2019 new issuance came in at $129bn, down 7% from $139bn last year. March posted $48bn in new issuance, down 9% from $53bn last year, with y/y declines in ABS and CMBS.

Making up nearly half of ABS issuance, auto ABS was up 13% y/y to $30bn in Q1. However, reduced issuance in non-traditional/esoteric abs, commercial abs (equipment, fleet lease, and floorplan), and other ABS subsectors kept total Q1 2019 issuance under last year's figure. Non-traditional ABS declined by 45% from Q1 2018 (down $5bn) and commercial ABS was down 18% (down $1.7bn). Overall Q1 ABS issuance came in at $60bn, down 13% from $69bn last year. For March, ABS posted just over $20bn, down 22% from last March. Our full year forecast remains at $240bn. To view our latest ABS commentaries and our January auto loan ABS tracker and our commentary The Severity Of Subprime Auto Loan Delinquencies Is In The Eye Of The Beholder, click here.

CLO new issuance reached $29bn in Q1, down 9% from Q1 2018. For the month of March, CLO new issuance was up 3% y/y coming in at $11bn. CLO resets and refis continue to be much lower this year and are currently at less than $10bn, down 70% from Q1 2018, as spreads began the year wider, and have shown few signs of tightening back to levels that would spur more activity. We are lowering our 2019 projection for CLO resets and refis to $60bn (from $110bn previously), while keeping new issue at $110bn. Click here to view our recent CLO publications including our commentary CLO Spotlight: The Fundamentals Of CLO Combination Notes.

Q1 CMBS new issue volume totaled $17bn, down from $19bn last year. March CMBS issuance was just over $7bn, down from $9bn in March 2017. Conduit issuance in Q1 came in at about $9bn, down $1bn from Q1 last year; and non-conduits came in at $8bn in Q1, down almost $2bn from last year's figure. (Note: We do not include CRE CLOs in our CMBS totals.). We reiterate our $80bn forecast, noting a recent pickup in activity, as well as a combination of lower rates and tightening spreads which is generally supportive of origination volumes. Click here to view our recent CMBS publications including our North American CMBS Loan Default And Loss Study.

Q1 2019 PL-RMBS issuance is having a strong year. Issuance was up 24% to $22bn in Q1 2019; and, for the month of March, issuance was up 41% to over $9bn. Q1 Non-QM issuance is now over double last year's figure coming in at over $5bn in Q1. Our full year forecast remains at $100bn. Click here to read our recent RMBS related publications including our Pre-2009 U.S. Residential Mortgage Performance Snapshot.

Turning to the Numbers…

The 10yr Treasury was 2.40% for the week ending March 29, down from 2.44% last week. NYMEX crude oil was up $1.13 w/w to $60.17. U.S. regular gas prices averaged $2.69 this week, up 8 cents w/w and up 4 cents y/y. The S&P 500 was up 1.20% w/w to 2834.4. The 30-year fixed-rate mortgage decreased to 4.06%, down 22bps w/w (down 38bps y/y). The Euro was trading at $1.1216, down $0.0088 w/w.

Recent Short Articles (available here)

February Posts $48bn as Volatility Subsided

U.S. Structured Finance Issuance: January Was Slow to Start, But Picked Up Steam Heading Into February

Four Ratings Raised, 232 Ratings Affirmed On 17 U.S. And Canadian Credit Card ABS Trusts

Buyer Beware: The Curious Case of Income Supplemented BTL

New Commingling Reserve Mechanism in German Auto ABS Requires Further Considerations in Our Cash Flow Analysis

Fewer Structural Protections in Today’s Speculative-Grade Subprime Auto Loan ABS

Single-B Subprime Auto Loan ABS Gain Popularity as Industry is Poised for Consolidation

Recent In-Depth Articles (available here)

U.S. Auto Loan: The Severity of Subprime Delinquencies in Eye of Beholder

U.S. Auto Loan ABS Tracker: January 2019

Request for Comment: Global Equipment ABS Methodology And Assumptions

An Overview Of China's Auto Finance Market And Auto Loan Securitization

CLO Spotlight: The Fundamentals Of CLO Combination Notes

CLO Spotlight: U.S. CLO Issuance Volume Remained High In 2018, While Collateral Quality Continued To Split Rating Performance

North American CMBS Loan Default And Loss Study: Defaults Improved In 2018, But Losses Worsened

U.S. Auto Loan ABS Tracker: Full-Year And December 2018 Performance

Will the Froth in the U.S. Housing Market Bubble Over? We Think Not

10-Year Retrospective: Changes In U.S. Auto ABS In The Decade Since The Great Recession

What Blockchain Could Mean for Structured Finance

Marketplace Lending and the True Lender Conundrum

U.S. Commercial ABS Outlook For 2019: Generally Stable, But With Increased Volatility

Credit FAQ: When The Cycle Turns: Assessing How Weak Loan Terms Threaten Recoveries

Credit FAQ: The Key Ingredients For Whole Business Securitization Ratings

SF Credit Brief: Nissan Downgrade Expected To Have Minimal Impact On U.S. Auto ABS

Leveraged Finance: A 10-Year Lookback At Actual Recoveries And Recovery Ratings

CLO Spotlight: Sector Averages Of Assets Held In Reinvesting U.S. BSL CLOs: Fourth-Quarter 2018

Transaction-Specific 'B' Economic Stress Loss Projections For U.S. And Canadian CMBS Transactions As Of December 2018

CDO Spotlight: Performance Benchmarks For S&P Global Ratings-Rated CLO Transaction: Fourth-Quarter 2018

CLO Spotlight: The Most Widely Referenced Corporate Obligors In Rated U.S. CLOs: Fourth-Quarter 2018

As Boom In U.S. Lodging Industry Slows, CMBS Backed By Hotel Loans Face Changing Market Conditions

U.S. CMBS Conduit Update Q4 2018: Metrics Deteriorated A Bit, Stable Ratings Expected In 2019 With Some Caveats

Global Structured Finance Outlook 2019: Securitization Continues To Be Energized With Potential $1 Trillion in Volume Expected Again

Quarterly U.S. Credit Card Quality Index: Performance Remains Stable As Issuance Volume Declines

Take Notes (available here)

Take Notes: Across The Pond With European CMBS

Take Notes: Conference Recap: SFIG Vegas 2019

On PACE For A Greener Future In Structured Finance

Conference Recap: CREFC 2019 And A Look Across The CMBS Market

The Lowdown On LatAm

Hot Takes From Opal’s 2018 CLO Summit

When You Use Your Whole Business To Securitize…

The "Unwoke" Millennial Housing Market

The Perfect Storm... For Defaults?

ABS East Recap

Recent Presales (available here)

U.S. ABS: HART 2019-A

U.S. ABS: FIAOT 2019-1

U.S. ABS: Trinity Rail Leasing 2019 LLC

APAC RMBS: RESIMAC Triomphe Trust - RESIMAC Premier Series 2019-1

U.S. CLO: Maranon Loan Funding 2019-1 Ltd

U.S. CLO: Ares LIII CLO Ltd.

U.S. CLO: Bain Capital Credit CLO 2019-1

U.S. CLO: LCM 30 Ltd.

U.S. CLO: THL Credit Wind River 2019-3 CLO Ltd.

U.S. CLO: Madison Park Funding XXXIV Ltd

U.S. CMBS: BAMLL Commercial Mortgage Securities Trust 2019-AHT

U.S. RMBS: Verus Securitization Trust 2019-INV1

U.S. ABS: SoFi Professional Loan Program 2019-B Trust

APAC RMBS: Triton Trust No.8 Bond Series 2019-2

Recent European Articles and Presales (available here)

S&P Global Ratings Comments On The Czech Republic's Revised Covered Bond Framework

Spanish Mortgage Loans IRPH Benchmark Index Under Scrutiny

German Covered Bond Market Insights 2019

Credit FAQ: How We Analyze Residential Mortgage Loans Backing Hungarian Covered Bonds

French Covered Bond Market Insights 2019

Changes Ahead: How Spain's New Mortgage Law Could Affect New And Outstanding RMBS Transactions

Spanish Covered Bond Market Insights

Countdown To Brexit: Uncertainty Created For Cross-Border Derivative Contracts Supporting Structured Finance Transactions

Global Covered Bond Characteristics And Rating Summary Q4 2018

New Issue: Income Contingent Student Loans 2 (2007-2009) PLC

Presale: STRONG 2018 B.V.

Presale: Salus (European Loan Conduit No. 33) DAC

New Issue: Citizen Irish Auto Receivables Trust 2018 DAC

|