|

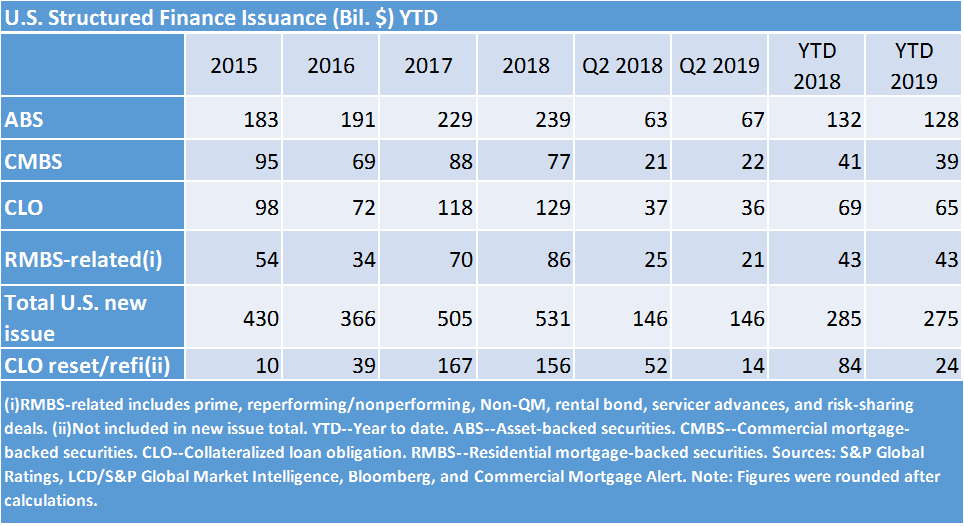

Some $45bn in June Issuance; $146bn in Q2; $275bn YTD (Erb/Manzi)

U.S. Structured Finance (SF) new issuance volume came in at $45bn for June, including $21bn ABS, $10bn CLO, $8bn CMBS, and $6bn PL RMBS. The June figure resulted in a total for Q2 of $146bn (unchanged y/y), and $275bn YTD (-4% y/y). The slight decline in the y/y comparison was mostly due to broader market volatility in Dec 2018/Jan 2019. Q2 2019 ABS new issue volume of $67bn exceeded Q2 2018 by about 7%, led by strong gains in auto ABS (+4bn q/q), personal loan ABS (+2bn), and commercial ABS (+2bn) volume. Credit card ABS volume was down. YTD, ABS volume is now at $128bn, down just slightly from $132bn last year. On the publication side, we recently released our April auto loan ABS tracker and semi-annual timeshare indices reports. Both are available here. CLO new issue volume of $36bn in Q2 and $65bn YTD were off 2% and 5% versus the comparable 2018 periods. Higher liability spreads continue to hold back CLO resets and refis, where issuance is down by over 70% both y/y YTD and y/y for Q2. Click here to view our recent CLO publications including Easy Credit Fuels Growth In U.S. Middle Market CLO Loans and a two credit FAQ articles related to our updated CLO (and CDO) criteria Global Methodology And Assumptions For CLOs And Corporate CDOs. Following a more active May/June period, CMBS issuance of $22bn in Q2 brought the YTD figure to $39bn, not far behind the 2018 pace. Our full-year 2019 forecast (ex CRE CLOs) remains at $80bn. Click here to view our recent CMBS publications including Rising Self-Storage CMBS Exposures Have Investors Asking Questions and Co-working May Come With Risks For Office Landlords And CMBS Investors. Private Label RMBS-related issuance was down about 17% y/y in Q2 to $21bn, but flat on a year-over-year basis for 2019 thus far, at $43bn. Non-QM continues to have a strong year and is currently at about $10bn YTD, about double 2018's figure. Click here to read our recent RMBS related publications including Key Factors For Assessing U.S. Non-Qualified Mortgage Bank Statement Loans. Turning to the Numbers…

The 10yr Treasury was 2.01% for the week ending 28, down from 2.06% last week. NYMEX crude oil was up $0.77 w/w to $58.20. U.S. regular gas prices averaged $2.71 this week, up 4 cents w/w and down 15 cents y/y. The S&P 500 was down 0.29% w/w to 2941.76. The 30-year fixed-rate mortgage decreased to 3.73%, down 11bps w/w (down 82bps y/y). The Euro was trading at $1.1372, about flat w/w.

Recent Presales (available here)

U.S. CLO: OCP CLO 2019-17 Ltd.

U.S. RMBS: FWD Securitization Trust 2019-INV1

U.S. ABS: CFG Investments Ltd. Series 2019-1

U.S. CLO: Battery Park CLO Ltd./Battery Park CLO LLC

U.S. CLO: Fortress Credit BSL VII Ltd.

U.S. ABS: Mariner Finance Issuance Trust 2019-A

U.S. CLO: Carlyle US CLO 2019-2 Ltd.

U.S. RMBS: Residential Mortgage Loan Trust 2019-2

U.S. ABS: College Avenue Student Loans 2019-A LLC

U.S. CLO: Black Diamond CLO 2019-2 Ltd./Black Diamond CLO 2019-2 LLC

U.S. CLO: Woodmont 2019-6 L.P./Woodmont 2019-6 LLC

U.S. CMBS: GS Mortgage Securities Trust 2019-GC40

Recent EMEA Presales

Small Business Origination Loan Trust 2019-2 DAC

GREEN STORM 2019 B.V.

Silver Arrow S.A., Compartment 10

Limes Funding S.A., Compartment 2019-1

Freemens Common Villages LLP

Ciel No. 1 PLC

Take Notes (available here) Conference Recap: Global ABS In Barcelona

Conference Recap: IMN CLO Conference 2019

Co-Working On The Rise A New Office Space For CMBS And REITs

Covering New Ground: Covered Bonds Expand Into New Markets

Blockchain On The Brain

Across The Pond With European CMBS

Conference Recap: SFIG Vegas 2019

On PACE For A Greener Future In Structured Finance

Conference Recap: CREFC 2019 And A Look Across The CMBS Market

The Lowdown On LatAm

2019 U.S. New Issuance in a Virtual Dead Heat With 2018 After a $48bn May

Some $53bn in April Structured Finance New Issuance Pushes 2019 Ahead of 2018 Pace

$129bn in Q1 Issuance with $48bn in March

February Posts $48bn as Volatility Subsided

U.S. Structured Finance Issuance: January Was Slow to Start, But Picked Up Steam Heading Into February

Buyer Beware: The Curious Case of Income Supplemented BTL

Fewer Structural Protections in Today’s Speculative-Grade Subprime Auto Loan ABS

Recent In-Depth Articles (available here)

Global Covered Bond Insights Q2 2019

Global Covered Bond Characteristics And Rating Summary Q2 2019

S&P Global Ratings' Covered Bonds Primer

Easy Credit Fuels Growth In U.S. Middle Market CLO Loans

S&P Global Ratings' Covered Bonds Primer

U.S. Auto Loan ABS Tracker: April 2019

Cycle Turn Will Test European CLO 2.0 Defaults

Credit FAQ: Questions Over Electric Vehicle Residual Values In European Auto ABS

CLO Spotlight: European CLOs: Lack Of Loan Supply Is Causing Further Portfolio Overlap

Servicer Evaluation Spotlight Report™: Commercial Mortgage Servicers Deal with a Faulty but Functioning Flood Insurance Program

Credit FAQ: How We Rate Korean Covered Bonds

U.S. Auto Loan ABS Tracker March 2019

Spotlight On Italy's Securitization Market On The 20th Anniversary Of Law 130

CLO Spotlight: Once Upon A Time: A Look Back At 15 Years Of U.S. BSL CLO Industry Exposures

U.S. Timeshare Securitization Performance Index: New Issuance Grew In Second-Half 2018 As Defaults Remained Near 10-Year Average

Default, Transition, and Recovery: 2018 Annual U.S. Corporate Default And Rating Transition Study

|