|

U.S. Structured Finance New Issuance Volume at $64Bn in November, $541Bn YTD (Manzi/Erb)

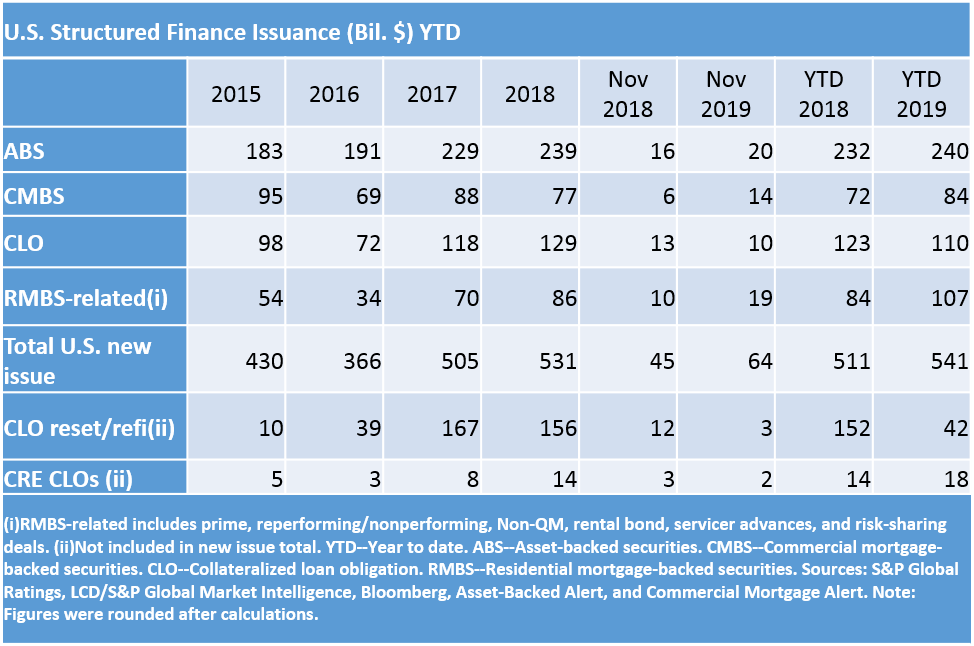

U.S. Structured Finance (SF) new issuance volume reached $64bn in November, with $20bn in ABS, $14bn in CMBS, $10bn in CLOs, and $19bn in private label RMBS. Monthly issuance was up by about $19bn from last November's reading, with gains in each major SF sector save CLOs. U.S. SF new issuance volume now totals $541bn YTD, up 6% y/y, and already eclipses 2018’s full year figure of just over $530bn. Scroll down for the summary table.

ABS issuance volume reached $240bn YTD at the end of November, up 3% y/y, following a $20bn month. Our full year 2019 forecast was $245bn, which is likely to be a bit low, but not too far off on a percentage basis. While credit card and student loan ABS issuance are down y/y, autos, equipment, and personal loan ABS gains have more than made up the difference. On the publication side, we recently released our September 2019 U.S. Auto Loan ABS Tracker, available here.

CMBS issuance reached $84bn YTD in November, up 17% y/y (note that we do not include CRE CLOs in our CMBS totals), eclipsing our $80bn forecast for 2019, which had been on the high end of the range of most forecasts made earlier this year. At this point a figure closer to $90bn looks more likely. Both conduit and SASB have been active of late; indeed, November’s monthly total of over $14bn is the highest print since November 2007, according to Commercial Mortgage Alert data.

CLO new issue volume was $110bn YTD as of November, matching our full year forecast. This is the only sector down y/y; granted, 2018’s total was the highest ever recorded for the sector. CLO reset/refi issuance continues to be down by over 70% this year, now at $42bn, which included $3bn in November. For more on CLOs, read our recent publication that provides color on the record exposure to B- obligors via scenario analysis: To B- or Not to B-, a Scenario Analysis in Three Acts, available here.

Private label RMBS issuance reached $107bn YTD in November, up 27% y/y, and exceeding our initial full year forecast of $100bn. Non-QM volume remains strong at about $23bn YTD, well over double 2018's 11-month figure. For more on RMBS and housing, see For U.S. Rental Housing Issuers, Scarcity Is A Good Thing, available here.

Keep an eye out for the executive summary of our 2020 global SF outlook, which we’ll release in mid-December. We expect to have the full article (along with a webcast invitation) available sometime during the second week of January.

Recent Presales (available here)

U.S. Auto: Ally 2019-4

Australian RMBS: Firstmac No. 4 Series 4-2019

U.S. CLO: Magnetite XXIV

U.S. RMBS: CSMC 2019-NQM1

U.S. CLO: Barings CLO Ltd. 2019-IV

U.S. CLO: GoldenTree Loan Management US CLO 6 Ltd

U.S. RMBS: Bunker Hill Loan Depositary Trust 2019-3

Recent EMEA Presales (available here)

Elvet Mortgages 2019-1

CVC Cordatus Loan Fund XVI DAC

Auto ABS UK Loans 2019 PLC

Towd Point Mortgage Funding 2019 - Vantage2 PLC

Cardiff Auto Receivables Securitisation 2019-1 PLC

Canada Square Funding 2019-1 PLC

VCL Multi-Compartment S.A. , Compartment VCL 29

Towd Point Mortgage Funding 2019 – Auburn 13 PLC

Globaldrive Auto Receivables 2019-A B.V.

Northwoods Capital 19 Euro DAC

Take Notes (available here) Covering More New Ground: The Rise Of Sustainable Covered Bonds

Incorporating ESG Into Our Structured Finance Framework

Conference Recap: ABS East 2019

U.S. Student Loans: Should We Forgive And Forget?

What's Up (CLO) Docs?

What Are Investor Property DSCR Loans

Conference Recap: European Structured Finance Conference 2019

The Evolution Of Marketplace Lending

RMBS Down Under

Conference Recap: Global ABS In Barcelona

What’s Heating Up in the Solar ABS Space

Conference Recap: IMN CLO Conference 2019

Co-Working On The Rise A New Office Space For CMBS And REITs

Covering New Ground: Covered Bonds Expand Into New Markets

Blockchain On The Brain

Across The Pond With European CMBS

U.S. Structured Finance New Issuance Volume at $69Bn in October, $477Bn YTD

September's $50bn Pushes U.S. SF Issuance to $129bn in Q3 and $409bn YTD, Equaling 2018 Pace

August Brings $39bn in Issuance; YTD Total Down 5% Y/Y

New Issuance at $39Bn in July; $315Bn YTD, Down 5% Y/Y

H1 2019 U.S. New Issuance Volume at $275bn; Off 4% Y/Y

2019 U.S. New Issuance in a Virtual Dead Heat With 2018 After a $48bn May

Some $53bn in April Structured Finance New Issuance Pushes 2019 Ahead of 2018 Pace

$129bn in Q1 Issuance with $48bn in March

February Posts $48bn as Volatility Subsided

U.S. Structured Finance Issuance: January Was Slow to Start, But Picked Up Steam Heading Into February

Buyer Beware: The Curious Case of Income Supplemented BTL

Fewer Structural Protections in Today’s Speculative-Grade Subprime Auto Loan ABS

Recent In-Depth Articles (available here)

Dutch Covered Bond Market Insights 2019

How STS Has Shaken Up European Securitization So Far

Credit FAQ: CLO Rating Movements: Same Credits, But Different Strokes For Different Notes

Australian Prime And Nonconforming RMBS: What's The Difference?

Canadian Credit Card Quality Index: Lower Issuance, Stable Receivables And Performance In Third-Quarter 2019

An Overview Of Australia's Housing Market And Residential Mortgage-Backed Securities

Rise In Repayments Expected For U.K. Legacy Borrowers

For U.S. Rental Housing Issuers, Scarcity Is A Good Thing

CDO Spotlight: Sector Averages Of Reinvesting US BSL CLO Assets: Credit Quality And Loan Prices Fall In Third-Quarter 2019

Prospects Decline, Risks Climb

Recovery Prospects Soften On Uptick In 'B-' Issuance: European Leveraged Finance And Recovery Update, 3Q2019

Expanding Portfolios Underpin Steady U.S. ABCP Issuance, Though Market Uncertainties Persist

Auto Finance Securitization In Asia-Pacific Could Drive In New Directions

U.S. Auto Loan ABS Tracker: August 2019

SME Loan Securitization: An Evolving Landscape In Asia-Pacific

U.S. Auto Sector Faces Bumpy Roads Ahead With Rising Recession Odds And Falling Demand

Global Securitization Issuance After Three Quarters Still On Course For Another Trillion Dollar Year

Japan Credit Spotlight: Securitization Stability Likely Despite External Wobbles

October 2019 European CMBS Monthly Bulletin

With The Ongoing Lawsuits Against Two Securitization Entities, How Will Credit Card Receivables Asset-Backed Securities Be Affected?

CLO Spotlight: Third-Quarter CDO Monitor Benchmarks Reveal Relative Credit Quality And Diversity Of CLO Portfolios

The Most Widely Referenced Corporate Obligors In Rated U.S. BSL CLOs: Third-Quarter 2019

U.S. CMBS Conduit Update Q3 2019: Debt Service Coverages On The Rise

Trending Assets: Brazil Continues To Lead Structured Finance Issuance In Latin America

Next Debt Crisis: Earnings Recession Threat

|