|

| |

As part of our continuing effort to furnish the market with relevant and timely information, the S&P Global Ratings Team is rolling out SF Insights. We plan to focus on providing our thoughts and insights on deal developments for SF asset classes beginning with CMBS. The report will highlight analyst summations of transaction-level updates based on their review of reported information and current market news. We hope the report complements our traditional publication and communication channels and we welcome feedback as to how we may improve upon its utility to our clients and customers.

CMBS Transaction Highlights CMBS Transaction Highlights

Maroon Loan - Elizabeth Finance 2018 DAC (Chu)

As per the Special Notice received from CBRE, the valuation of the Maroon Properties has decreased to £86mn (decrease of £18.7mn) resulting in a loan default and transfer to the special servicer as the borrower has failed to cure this breach. Based on the updated valuation, the Maroon Loan to Value is 77.7% whereas the borrower is obliged to ensure that the Maroon Loan to Value does not, at any time, exceed 75%. A Notice has also been served to the Mezzanine Lender who may within 15 Business Days cure the Event of Default. S&P Global Ratings methodology is based on a recovery analysis, assuming a loan default. Our S&P Value at closing of the transaction was £82 million.

DECO 8 - UK Conduit 2 PLC (Chu)

The special servicer confirmed that an amount of £2.3 million which constitutes net disposal proceeds from the sale of the last asset securing the Rowan (UK) Commercial Property Loan shall be available for distribution by the trustee. This amount was included in the recoveries, however had not been applied towards repayment of the Loan. This amount together with accrued interest has been transferred and will be distributed to Noteholders and other Secured Parties in accordance with the Post Enforcement Priority of Payments.

Ribbon Finance 2018 PLC (Ladeira)

As per the Special Notice received Ribbon Bidco Limited notified CBRE Loan Services of a As per the Special Notice received, Ribbon Bidco Limited notified CBRE Loan Services of a planned strategic structural reorganization of the deal. The plan will involve the implementation of a separate Opco/Propco structure. The Ribbon Finance 2018 PLC transaction portfolio consists of 20 UK hotels managed under Holiday Inn and Crowne Plaza franchises. Currently, 'Project Ribbon' properties and hotel operations are held by a combined propco/opco owner - the "UK HotelCos"; legal ownership of both the hotel properties and hotel operations is held by "UK HotelCos". However the Restructuring has not yet been finalized. According to the transaction documents, the rating agencies that have assigned ratings to the notes would need to confirm that the restructuring of the borrower would not lead to a downgrade, withdrawal, qualification or suspension of the ratings.

Recent S&P CMBS Publications Recent S&P CMBS Publications

Prepayments In European CMBS: Friend Or Foe?

On May 16, 2019, we have published our commentary on the prepayment feature in CMBS transactions. Some CMBS transactions are backed by portfolios of properties and/or multiple loans. The loans usually feature minimal contractual amortization during the loan term (meaning the borrower pays both interest and principal over time, and the remaining loan balance at the end of the term), or none at all. This leaves a large payment ("bullet" repayment) on the loan's maturity date, and consequently significant refinance risk for the transaction. Borrowers making partial prepayments before a loan reaches maturity can reduce refinance risk and therefore improve the lender's position. But, is this really the case? S&P Global Ratings has conducted various scenario analyses to test this. Our analysis shows that these risks vary depending on each transaction's features and therefore need to be analyzed on a case-by-case basis. These risks may affect our ratings, absent any adequate mitigant.

For more details click here.

European CMBS Monthly Bulletin (June 2019)

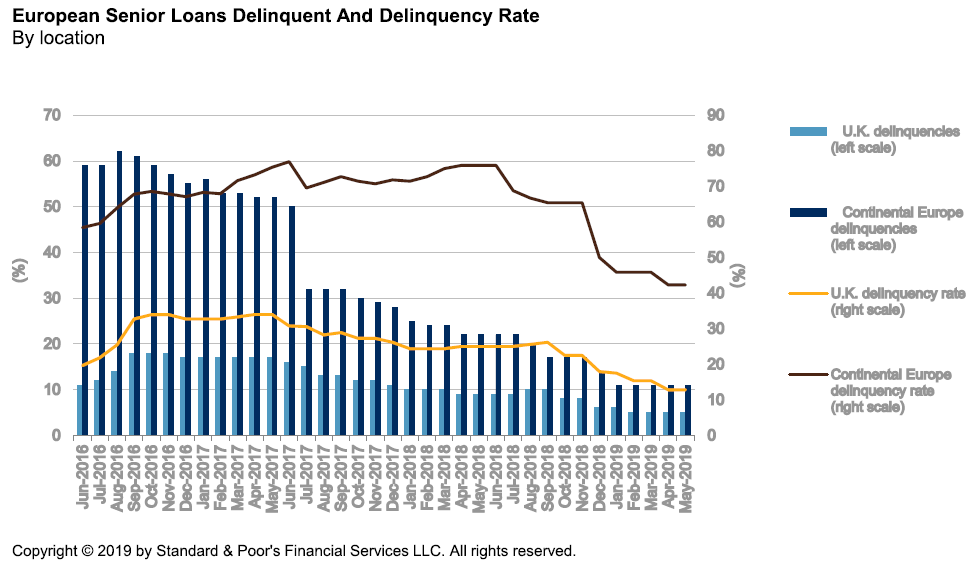

The number of delinquent loans remained constant at 16, and the number for special serviced loans increased to 17 from 16. Out of the €29.8 billion outstanding loan balance, €1.35 billion is scheduled to mature in the coming 12 months.

For more details click here.

|

| |

|

|

|